In this video webcast series we will discuss the importance of Life Events and their impact on one’s financial journey.

As we are all aware, “COVID-19” has forever changed how banks, financial services, and insurance companies will conduct business. However, the fact still remains that almost 60% of the US population lives paycheck to paycheck, doesn’t have enough in savings to last 3 months, and can’t afford an unexpected bill of more than $400. While the other 40% who are well on their way to retirement they are now more concerned about their nest egg, their estate plans, and do they have enough money to survive a long-term or a critical life event.

Therefore, we will be interviewing some of today’s best-known FinTech Companies, Industry Consultants, Practitioners, and Service Providers to get their view on Life Events. and if they are using them to help companies; Differentiate their products and services, add to their Value Proposition, and/or operate within a Fiduciary, Suitability, and Best Interest environment.

Share this article

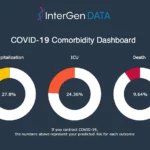

InterGen Data and Brandeis International Business School Launch COVID-19 Comorbidity Dashboard

December 16, 2020 06:00 AM Eastern Daylight Time Interactive tool uses demographic data from 8.4 million records to predict the potential…

MetLife Digital Accelerator Partners with 10 Startups to Develop Financial Wellness and Engagement

September 15, 2020 09:30 AM Eastern Daylight Time 10 new startups selected to join the 2020 MetLife Digital Accelerator powered by…

InterGen Data named as one of the Top 250 InsureTech firms for 2020 by Novarica

InsureTech Startup Market Continues to Grow, with Increased Focus on Customer Experience and Rapid Time-to-Value for Insurer Partners, Say Novarica

Novarica’s annual report profiles 250…