InterGen Data was recently mentioned on Finovate. A copy of the original article “MassChallenge’s 2020 Fintech Accelerator Class Features Finovate Alums” by David Penn can be found at https://finovate.com/masschallenges-2020-fintech-accelerator-class-features-finovate-alums/.

Six Finovate alums innovating in fields ranging from life event planning to small business lending are among the 34 startups that will participate in the upcoming 2020 MassChallenge FinTech program. In addition to mentorship from and collaboration with leading enterprise partners, startups will get access to free office space and the opportunity to compete for equity-free cash prizes as part of their six-month engagement.

Calling this year’s cohort part of the “exciting future of fintech,” MassChallenge Fintech Managing Director Devon Sherman said the incoming class “represents a revolutionary approach to financial services” and added that his team was “blown away by the vision of these entrepreneurs.”

Making the cut among Finovate alums are:

Cinchy – FinovateFall 2019

Hydrogen – FinovateEurope 2018

InterGen Data – FinovateFall 2019

LendingFront – FinovateFall 2016

Overbond – FinovateFall 2017

Stratyfy – FinovateSpring 2018

See the full roster of incoming startups to the 2020 cohort.

“Thanks for including Hydrogen in MassChallenge 2020,” the company wrote on Twitter. “It is a great honor. We look forward to working with all of the enterprise partners and startups in the program.”

“LendingFront is proud to be participating in the 2020 MassChallenge Fintech program,” the company tweeted. “We will be working with the City of Boston and several New England financial institutions to use our technology to improve how small businesses get access to capital.”

And from InterGen Data, one of our newest alums, company CEO Robert Kirk expressed his enthusiasm for the opportunity as well. “I believe that by working with our enterprise partner, we will be able to redefine the client experience, improve the lives of their clients, and deliver on the promise of how artificial intelligence and machine learning can vastly improve their financial journey,” Kirk said.

The MassChallenge accelerator program is supported by a public-private partnership including founding partners Massachusetts Mutual Life Insurance Company (MassMutual), Putnam Investments, Fidelity Investments, Citizens Bank, John Hancock, and the Massachusetts Competitive Partnership (MACP), as well as numerous challenge partners.

The program runs from January to June, and focuses on one-on-one “outcome-driven” partnerships between program participants and program partners. Together, the startup and the partnering company work to develop solutions for specific challenges while helping the startup coming scale its business.

Now in its second year, MassChallenge’s fintech program produced a 2019 cohort in which 70% of participants launched a pilot or proof of concept within a year. “Our inaugural year achieved promising results in driving international partnerships between fintech startups and our enterprise partners,” Sherman said. He added that he was excited “to build on that success in 2020.”

Founded in 2010, and offering an accelerator in healthtech as well, MassChallenge has worked with more than 2,000 startups, who have raised collectively more than $5 billion in funding and generated more than $2.7 billion in revenue. MassChallenge is U.S.-based, with offices in Boston, Rhode Island, and Texas, as well as Israel and Mexico.

Share this article

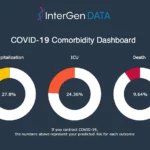

InterGen Data and Brandeis International Business School Launch COVID-19 Comorbidity Dashboard

December 16, 2020 06:00 AM Eastern Daylight Time Interactive tool uses demographic data from 8.4 million records to predict the potential…

MetLife Digital Accelerator Partners with 10 Startups to Develop Financial Wellness and Engagement

September 15, 2020 09:30 AM Eastern Daylight Time 10 new startups selected to join the 2020 MetLife Digital Accelerator powered by…

InterGen Data named as one of the Top 250 InsureTech firms for 2020 by Novarica

InsureTech Startup Market Continues to Grow, with Increased Focus on Customer Experience and Rapid Time-to-Value for Insurer Partners, Say Novarica

Novarica’s annual report profiles 250…