Robert Kirk was a guest on the #ItzOnWealthTech Podcast with Craig Iskowitz on October 7, 2019. Listen live or download the entire podcast episode using the download link above. To view a copy of the original article, visit https://wmtoday.com/2019/10/07/itzonwealthtech-ep-27-ai-as-a-gypsy-fortune-teller-with-robert-kirk-from-intergen-data/.

Robert Kirk is a financial services industry executive with over 28 years of experience in wealth management, clearance and settlement, and brokerage. Throughout his career, he has developed business aligned solutions that are built around the fast-paced evolution of technology and innovation in multiple sectors.

Currently, he is the Founder and CEO of InterGen Data, Inc. which is a firm that is focused on providing proprietary AI – machine-based learning that helps companies identify when their clients are likely to have important life events occur, what they could be, and how much of a financial impact that each could represent.

Previously, he was the Principal Consultant for Wealth and Brokerage at Mphasis, a Blackstone Company – where he was the core contributor in developing proprietary solutions and frameworks for digital transformation, customer experience, and risk and compliance that drove over $100 million in business value to their clients and the firm.

Prior to that, he was the Chief Information Officer for 1st Global, a top 40 independent broker where he was responsible for all technology and advisor tools to more than 400 CPA & legal firms with 1,100 independent financial advisors with assets under control of approximately $20 Billion.

Now hit the Play button!

This episode of Wealth Management Today is brought to you by Ezra Group Consulting. If your firm is evaluating new technology or looking to improve your current wealth platform, you need to contact Ezra Group. Don’t spend another day using technology that doesn’t offer an elegant user experience. Your advisors and clients deserve better and you can deliver it to them with the help of Ezra Group.

Topics Covered in this Episode

- A brief overview of InterGen Data [04:24]

- Current AI trends in wealth management [06:02]

- How the practical application of AI in other industries translates into wealth [08:16]

- How predictive analytics can be leveraged to enhance financial planning [11:45]

- Under the hood of InterGen software [14:52]

- How these sorts of advances are going to change how advisors interact with clients [18:23]

- Once AI starts to help advisors, what’s to stop robo advisors from using the same AI to take business away from advisors? [25:20]

- Discussion around how far away we are from computers becoming self aware [27:05]

- How AI can help with compliance [31:41]

Other Resources:

If you are interested in more information about some of the topics Rob and I discussed, these blog posts would be useful:

- Zen and the Art of Artificial Intelligence with Davyde Wachell from Responsive

- 8 Amazing Updates on the AI Digital Marathon in Wealth Management

- A Consultant’s View on the Leading Vendors in AI for Wealth Management

- 6 Ways AI is Helping Build Consumers’ Confidence in Banking

Complete Episode Transcript:

Craig: And welcome again to another episode of Wealth Management Today’s podcast. I’m here with my guest, Rob Kirk, the Founder and CEO of InterGen Data. Hey Rob!

Robert: How are you?

Craig: Excellent, thank you for being here.

Robert: Oh, thank you for the invite. It’s great to talk to someone as yourself, who has their pulse on the street.

Craig: My finger on the pulse, as they say. So Rob, give me a quick, one-minute overview of what InterGen Data does.

Robert: Absolutely, thanks Craig. InterGen Data is a company that is based on machine learning; we use a lot of AI and predictive analytics in that sense. And what we do is we help banks, financial services firms, and insurance companies learn more about their customers. Specifically, we help them predict when their customer’s most important life events might occur, what they’re likely to be, and how much of an economic impact they can actually represent to them and their financial journey.

Craig: I love this stuff. So AI-type of technologies are things that I know I’ve been getting into for a while, and people like to hear about it. I think this is the cutting edge and where everything is moving. So as the CEO and Founder of an AI firm, you are on the pulse of AI trends and what’s going on. Can you tell me a couple of AI trends you’re seeing? We talked a little bit before about what kind of practical applications firms are deploying now, that before AI was sort of pie in the sky, Terminator stuff – now we’re seeing practical applications. So what are you seeing most often being used, or AI being deployed as?

Robert: I’m seeing it in several areas. Let’s talk first on the practical side. We see AI being used in pattern recognition; understanding the nuances that would relate to stuff like brain cancer, lung cancer, or macular degeneration within your eye. That you add on this little lens and you can look through your iPhone and it would actually tell you, here’s what’s going on and here’s how it looks. In fact, that the computer can difference between hundreds of thousands if not millions of different color sets; the difference between fuchsia 2.001 versus a different fuchsia is very big. So from the medical and health sciences, it’s been huge. From other sciences, we’ve seen where they’re 3-D printing lungs and they’re using the math around how to actually use STEM cells to create human organs, or BMW or Honda having auto and self-driving motorcycles that use your iPhone app to call your motorcycle and it drives to you, and it auto-stabilizes so it doesn’t fall over.

Robert: Those are some of the more unique and practical that we’ve seen. But I think from this point, what we’re seeing is a change of how do we take that, and how do we go into other industries? And the explosion has just been absolutely tremendous. We’ve seen it in a number of different ways, going not just in the sciences or in the health area, but in understanding people and understanding what they do. So those are the biggest practical trends we’ve seen recently.

Translating AI into Wealth Management

Craig: Those are all incredible, stuff that’s changed the way we’re going to be living. But how do those different areas of practical applications in other industries, how does that translate into wealth management?

Robert: That’s a great question, because the translation is around not only pattern recognition not optically, but understanding the data. So here’s a great way that I’ve seen some very big firms take a look at this. They have a lot of customers, let’s say it’s a large custodial firm and they have 4 million customers, they have this call center, they have a service and support center, they have advisors, and they have people that help them. So what they’re noticing is who’s calling; they’re starting to track more information from what particular time does this group of people call, and what are they calling about? What are the common requests? We know that there are basically five ways that any one person can interact with an advisor: you can physically talk to them like we’re doing today, you can e-mail or text the person, you can log in online, you can send in that request if you want to, or you could actually work with a chat bot. So there’s many ways that they can do this, and typically they’re going to call either your sales organization, your support organization, or your services.

Robert: So if it’s sales, it’s going to be hey, I’d like to find out about this financial plan or this type of an investment product. And they’re taking the data of who’s calling, what they’re calling about, why they’re calling and what information was given to them, and they’re starting to put that into very large sets of data. They’ll do the same thing for the support side. When someone comes in and says, “Where’s my money? Did my trade settle? Where’s my check? Where’s my ACAT?” Or on the other side where they’re saying I forgot my password, I don’t know my information, I need to find out about my account, or can you help me with other issues? And they’re grouping that data together and then they’re starting to see patterns of, typically people only call for very few reasons; you don’t call your advisor to constantly talk about children and 50 other things, you call for a reason. You log into your account at your bank for a reason.

Robert: And they’re starting to see the similarities between the types of people, so people who are accumulators in wealth, people who are decumulators, people who are trying to set up estate plans, and they’re grouping them by various types of things. And that data is amazing, because now what they’re starting to see is these groups of people tend to call at this time of the month or at the end of the quarter, when they’re concerned about their fees or how they’re doing. Well if they’re starting to get that data in advance, maybe the firms and what they’re doing and where I’m seeing this is they’re taking that data and then they are sending out emails, they’re sending out alerts ahead of time, and that reduces the call volume, it reduces the cost and expense. And the customers themselves start to say, “Hey, this guy knows me.

They’re starting to send me information that’s relevant to me.” And that’s powerful.

Predictive Analytics

Craig: Yes, it seems very powerful. And what’s the next step in my mind, and I know we were discussing this a little bit before, was once it translates into wealth management then and you’ve got all that data building up in these different wealth management silos, how can you then use predictive analytics to leverage that data to enhance things like financial planning?

Robert: Well that’s a huge topic, and it’s one that’s dear to my heart. I started the company based on my grandfather and him passing away. He passed away at 96, but he had Alzheimer’s and it was something that affected our family; it was a life event. And that life event was so impactful that I saw all of us, my parents, myself, family members, relatives, making some poor decisions financially, because it was all based on emotion, right? It’s a loved one, but when somebody gets to the 90-year-old stage you have to start thinking, “Why didn’t we plan for this?” We didn’t realize this, this is back in 2011, but the costs were $12,000 a month for a long-term care facility, $1,800 a month for medication, and roughly around $400 or $500 for special care. This is a $170,000 plus venture for four years that we had to put on, and that’s a number that should scare all Americans. So when we think about how AI can help, it goes to the crux of me starting this business. I said, there’s got to be a way that we should have planned for this, there’s got to be a way that we needed to look at it.

Robert: And so what I saw and started to go after was, if financial planning tools and advisors don’t think about those things, is there a way to do that? And that’s where AI came in, and that’s where machine learning came in. That’s where looking at the data of what typically happens to people at certain times, what typically happens to them, and is this something that’s important?

I will also say that I have two beautiful daughters, 11 and 14, and I know now that in my financial plan I haven’t planned for two cars, two insurances, they’re going to say two proms or life events, two graduations, two colleges, two down payments on homes, and two weddings – and none of that’s in my financial plan. And unfortunately, the only way it’s added is by physically entering each number. And I think that if you know what’s coming up, you should be able to plan for it. So is there a way to automate this? Is there a way to grab that data and find it in comparison to people like me? The answer is yes, and the only way to do that is through machine learning,

Craig: Talking about all of those predictive events, one thing I liked when I saw the demo of your software is it predicts out based on your demographics, your genealogy, your heritage, what part of the country you live in, what your career choices are, or what you went to school for. How does that all work, and how does it figure out? If I’m a computer science major and I live in New Jersey, how does it know that you’re most likely to be married and within this range I have this many kids? How does that all work?

Robert: So let’s go back to my girls as an example. Let’s say that you had two girls and they were 24 and 27.

Craig: Let’s say I have three girls.

Robert: Okay. And what ages?

Craig: 24, 21, and 16.

Robert: All right, there you go. Your 21 and 24-year-old are close to the same age difference that my 14 and 11-year-old are. So I would come to you and say, “Hey Craig, when your daughters started driving what did you do?” And you would say, “I had to look at insurance, I had to do this. Don’t forget about this, and be careful of that.” You would actually start telling me your experiences. And when they went to college, what did you do? How long did it take? What did you pay? You would give me your experiences. That’s data. In essence, what I do is I take a look in my data set; I’ve got 10 years history of the US. So let’s say there’s 300 million people or 320 million people in the US, I go back 10 years and I say, let me take a look at what’s happened to other people, what have been their experiences? This is the only time you’re ever going to hear me say this, but thank goodness for government red tape; because when you buy insurance, you have to fill out paperwork.

Robert: When you get married, you have to fill out paperwork. If you happen to get divorced, you’ve got to fill out paperwork. If you buy a car, buy a home, if you go to school; in each one of these applications, they’re going to collect data such as your race, gender, where you live. Well that data, most of it, is public. So you can go find it, and if you find it you can start to correlate it to somebody that is like you. So if you think about it in essence or most simplistic nature, I take 320 million Americans and I drop that down to 160 million Americans because I’m male. I happen to be Native American Indian, so I drop that down to 12 million Americans. Then I turn around and say, how many work in financial services? How many work in technology? How many are doctors? How many are this, how many are that? I try and correlate that data, and then I historically go back and look at all the things that have happened to them that we’ve been able to capture. So I take that, and then I start to use more machine learning to correlate products and services. So what should you be thinking about, how much does it typically cost? If you live in New York and buy a home, it’s much different than if you live in Texas. That’s kind of the basics behind it, hopefully that gives you a good enough background.

How AI Changes Client Interaction

Craig: How do you feel this will this change? With more firms start using your software, how is that going to change how advisors interact with clients?Robert: I think that there are three main areas that it’s going to help. First, it helps you understand your client. It helps you have better, more contextual relationships with the people you’re talking to. You’re only as good as your updated information in your CRM, or how much information you remember about somebody. A good example, when I want to know somebody’s name that I forgot, I’ll go to my wife and if we’re in a public setting and I’ll say, “Hey, I want to introduce you to my wife Nikki.” And they’ll say, “Oh, my name is so and so.” She knows that that’s our little code that says Rob forgot that person’s name. I laugh about it, but the hard part is I can’t remember everything and everybody; but a machine can. So when the machine can help somebody not just keep track of the top 20% of their clients, it could keep track of all of their clients and all of the things happening. And what we would do with that data would be to help nudge the advisor to say hey, this person that you opened the account for 20 years ago is about to think about having a child themselves; maybe you should start talking to them or building a relationship or nudging them about a 529 plan, insurance, or maybe buying a home.

Robert: Those are the things that a computer can help you build that relationship. Because what I like to say is you’re contextually relevant to their time of life, right? Their stage of life. The second piece is you can actually let the computer start to automatically market to your clients for you, what I like to term as automated intelligent marketing. We can actually help you say, let’s drip market campaign these people, kind of a “set it and forget it.” The computer can start making these correlations faster than you can, and you don’t have to worry about it. Don’t do the mundane things; build the relationships, understand the products. That’s where you can be extremely helpful. And then using the computer to take away the administrative tasks, so looking at advisor efficiency. We think that’s going to be key. Thirdly, we think that another way this could be useful is in compliance. If you think about compliance in terms of, are you selling the right products and services to the right people? I look at it in terms of a life stage. We know for a fact you don’t sell annuities to 20-year-olds or 90-year-olds, unless you want to go directly to jail. However, if they have a certain level of income, if they have a certain liquidity status, if they’re a certain age, then you can actually start to say this is appropriate to sell this type of product to this person.

Robert: On the flip side of that, if it’s out of bounds then maybe you can start looking at different things. I’m not going down between lanes, I’m kind of going out of bounds. Maybe you should start to be alerted to those types of things. Or more importantly it is, maybe you should think about what the next best action would be. And that next best action to us is big, because if you have data that says I’ve got 50,000 clients that are run very well and they’re in compliance in terms of the products and services, and I’ve got another group of people that are 5 or 10 years earlier but look like those clients, then maybe you can also get involved in that and help them by understanding what these customers had, by also recommending new products. That maybe is four instead of three, but I think there’s a couple things there that could be helpful.

Robert: When my children graduate college, you know that the day they were born because if you’re my advisor, you would know when she was born because you have the information as a beneficiary. So you could actually plug in 14 years; plus 14, N plus 14, N plus 18, N plus 24, N plus 27. And if I can in my product give you events that say, here’s when they’re likely to get married, when they’re likely to buy their car, buy their home, have their children, you can help me help them, you can also help them. So anytime that that marketing can be tied directly to a product or service as well as to an individual that’s contextually relevant, it makes me think my advisor gets it. He knows me, I don’t even have to ask. And he is sending me the right stuff. That’s an advisor that is more than an advisor, they’re a trusted concierge. And that’s what I think is huge.

Craig: I want to take a little break from this episode to talk to you about one of my favorite sponsors, the Invest in Others Foundation. Invest in Others is a non-profit, you can find them at investinothers.org. They look to raise money and give out awards to charities that are sponsored by financial advisors, so it’s financial advisor’s favorite charities and charities that they spend a lot of time supporting. Invest in Others looks to get sponsorships from the industry and funnel that money to advisor’s favorite charities. I like this non-profit, I think you should take a look at it. Again, that’s investinothers.org. They have a couple other programs: one is a Grants for Good program, delivering money to different needy organizations and needy groups. They’re also starting a corporate awards program, which is going to be a little bit different but still within the industry and another way for financial services and wealth management corporations to help donate money to people in need. I like Invest in Others, I think you should take a look at them at investinothers.org.

Robo-Advisors Using AI

Craig: One question I hear a lot is that once AI starts to help advisors, what’s to stop robo advisors from using the same AI to take business away from advisors?

Robert: Interesting question. Most robos that I know today, ETFs, mutual funds, I don’t know any robo advisors that are doing insurance, estate planning, that are trying to look at your AMT amount, your passive tax amount, trying to bring that together as a family. I think that’s where the advisor has the edge. So if we look at the typical common, there’s debt, there’s investments, there’s education, there’s retirement, there’s insurance or tax, business planning, income planning, estate planning. And then special situations like my grandfather, that’s more wealth management. I think that the robos have a lot of learning that they’re going to have to do before they start offering all of those products. And during that duration, I can’t tell you what happens in 10 or 15 years, but I would gladly say I think that the advisors will still have a big edge. And if they can show their worth by helping individuals more as a family and helping them put everything all together, I think that they’re going to have their way for a while. That doesn’t detract from the crux of your question, which is can a robo advisor do that? And sure they can. But there’s a long line to understanding a specific product. And right now the robo advisors just aren’t that sophisticated yet, in my opinion.

Craig: How far away are we from them becoming sophisticated enough? When does Skynet become self-aware?

Robert: When Skynet becomes self-aware, we won’t know because just like our kid, no one taught them how to lie. When you ask them did you eat the cookie and they have chocolate on their face and say no, I didn’t do it. Not in me cookie. I think that when the computer does become self-aware, we’re not going to know because it’s going to hide itself. If you want to go the joking route, hopefully when the computer does learn that it is all-knowing, hopefully it realizes it makes a good pet and is obedient. But in reference to your question, I think it happens way sooner than anyone believes. And the reason why I say that is if you look at Kasparov and what IBM did almost 40 or 50 years ago, it piled through sequentially one decision to another decision to another decision to another decision. It had enough compute power to serially go through enough computations to beat a human.Robert: Today the systems are learning so much faster, and when I say so much faster, I’ll give you an example. On Facebook it was announced that they have AI that’s learned to beat top poker players in Texas Hold Em, because it knows how to bluff. And it did it within I think two weeks. The amazing part about that is, you and I can say, we’re going to meet every day and we’re going to play three hours, four hours a day, and we’re going to learn how to play Texas Hold Em. If you add up all those hours and the 365 and a quarter days, we get X amount of hours in. So let’s say we get that magic 10,000 hours alone, we’re only as good as we’ve been able to play each other. And that’s how much we learned. But the computer can learn by actually creating copies of itself. So it can have not 1,000, not 10,000, but 100,000 copies of itself playing against itself, learning on both sides. It can learn within a matter of weeks what would take a human a century.Robert: That steep curve is phenomenal, and I think people are underestimating that ability. Even if it’s wrong, it’s still going to learn something. I couldn’t give you the time, but I think that within three to five years, going back to your robo question, I think robos can learn to do simple products, some insurance, debt calculations and budgeting, and some additional things that would require more basic but more encompassing asset allocations, to include more products. So I think within three to five years you could see out of the 10 that I rattled off in wealth management, I think you’ll probably see them start to take a foothold in four of them. And that would probably be insurance, retirement, investment, and debt. Education is always going to be there, but you still need somebody to talk to. And unless the computers get much better at mimicking humans, then that might be a fifth way.

Craig: You grabbed my last question, my last question was what’s your prediction? But that’s good – you predicted what my question is! That’s impressive. Are you typing in all my questions into your system, and it’s predicting what my next question is going to be?Robert: No! But like Sophia the robot, I’ve already read all your blogs, I already understand you

AI-Powered Compliance

Craig: So you can just keep going, just pretend you’re me. One thing that I wanted to ask before we go was about compliance. What are some of the ways that you see AI helping with compliance?

Robert: That’s a big question. If you think of life events, and this is my true belief. No one buys insurance because it’s on sale; you buy insurance because you bought something, you broke something, or you created something. Those are life events that happen. If I can understand the likelihood of you getting a disease, so I’m Native American Indian, if I can give you the number that there’s 1.2 million people in Texas that are Native American Indian, that’s a good number. If I can give you the fact that 12.6% of them get arthritis, that’s another good number. But how do you get my propensity? How do you understand what’s my likelihood of getting arthritis? Well, we’ve come up with some novel ways. We’ve worked with and sought guidance through the FDA and the CDC, and it all relies upon heritage.

Robert: I’m not saying we’re going and taking a swab or taking a blood sample, but we’ve mathematically found a way to help generate information about when someone is likely to get sick, to have cancer or some debilitating disease, or something else, right? So it’s life events, good and bad. Marriage, divorce. And as we look at those events, we also look at the expenses, the products and the services, and what should be recommended. So if you’re recommending something outside of those bounds, if you’re looking at something that may or may not be suitable, we’re never going to tell you that it is or is not suitable. But we think we have a very good track on, here’s something that’s operating within the lanes, within your guard rails of the firm. And if it’s something that’s outside or getting close to the guard rail, we think we should alert you. Those alerts can be very proactive because we can sift through 20 million clients in a matter of hours, versus what it would take for you to hire 1,000 compliance people to go look at this data. We think we’re going to be able to find that data much quicker and then alert you to that. So those are some of the exciting things that we think in compliance could be very useful.

Craig: Those all sound great. I think a lot of firms are going to be revamping their entire infrastructure once these kinds of tools become more mainstream.

Robert: It’s certainly my bet. That’s where I’m putting my money.

Craig: Okay, well good luck. I hope that things work out. I like your product, and I’m looking forward to seeing some of the big things that are coming up at the end of this year for you guys.

Robert: I appreciate that

Craig. And to everybody who’s listening, thank you for joining in to

Craig. He’s an awesome guy and I love to love to hear him and all the stuff that you’re doing, so keep it up.

Craig: Rob, thank you so much.

Share this article

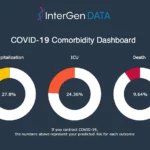

InterGen Data and Brandeis International Business School Launch COVID-19 Comorbidity Dashboard

December 16, 2020 06:00 AM Eastern Daylight Time Interactive tool uses demographic data from 8.4 million records to predict the potential…

MetLife Digital Accelerator Partners with 10 Startups to Develop Financial Wellness and Engagement

September 15, 2020 09:30 AM Eastern Daylight Time 10 new startups selected to join the 2020 MetLife Digital Accelerator powered by…

InterGen Data named as one of the Top 250 InsureTech firms for 2020 by Novarica

InsureTech Startup Market Continues to Grow, with Increased Focus on Customer Experience and Rapid Time-to-Value for Insurer Partners, Say Novarica

Novarica’s annual report profiles 250…