Novarica | 09.08.20

InsureTech Startup Market Continues to Grow, with Increased Focus on Customer Experience and Rapid Time-to-Value for Insurer Partners, Say Novarica

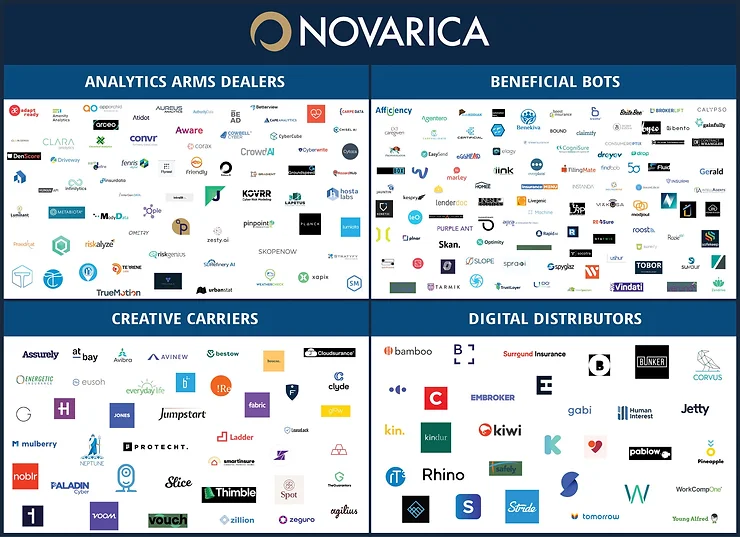

Novarica’s annual report profiles 250 InsureTechs with focus on opportunities to partner, learn, and create value

September 8, 2020 (BOSTON) – With time horizons shortened to reflect uncertainty about the future, insurance carriers investing in or partnering with InsureTech startups appear to be focusing on tactical initiatives that can produce more immediate results than some of the more speculative R&D efforts more common in the pre-pandemic era. In its fourth annual report, InsureTech for Insurers: 250 Startup Profiles, research and advisory firm Novarica outlines the InsureTech landscape for insurers, focusing on two key questions: Does this matter to my company? And what can we learn from it?

“One lesson that emerges from the 250 InsureTech startups Novarica has profiled in this report is that the insurance industry should rethink its consumer experience from every angle,” said Jeff Goldberg, Executive Vice President of Research and Consulting and co-author of Novarica’s new report. “Across all lines of business and across all sizes, insurers will feel the impact as InsureTech startups shift customer expectations and point the way for more effective, insightful operations.”

Among the key findings of the report are:

AI messaging is everywhere. Everyone’s talking about AI, but real AI is less clear. Even so, adoption of AI technologies like machine vision and natural language processing is growing across lines of business and use cases.

Insurance is going beyond direct online. Many startups are rethinking distribution, bringing products to consumers rather than simply enabling a direct online purchase.

Startups previously positioned as competitors are becoming partners. Many startup “carriers” are licensing their platforms to allow insurers to develop niche products and branch into new lines of business, though the effectiveness of this pivot is yet to be proven.

A preview of the report is available online at https://novarica.com/insuretech-for-insurers-250-startup-profiles/, and desk copies are available to qualified media. Please contact media@novarica.com or call Emily Lecaque at 833-668-2742 Ext. 121 for more information.

Novarica will also be drawing on this report in a Virtual Town hall meeting for insurer clients and research community members on Sept 15th. Details are at https://novarica.com/insurer-client-and-council-member-weekly-virtual-town-hall-2020/

About Novarica

Novarica helps more than 100 insurers make better decisions about technology projects and strategy. Its research covers trends, best practices, and vendors, leveraging relationships with more than 300 insurer CIO members of its Research Council. Its advisory services provide enterprise phone and email consultations on any topic for a fixed annual fee. Consulting services range from assessments and strategic roadmaps to vendor evaluations. Other special programs include a Silicon Valley Innovation Tour, InsureTech Summits, online learning courses, and more. https://www.novarica.com/

Press Contact:

Emily Lecaque

833-668-2742 Ext. 121

media@novarica.com

Share this article

Preparing for Intangible Moments – How InterGen Data is Using AI to Predict Life Events

Everyone knows the saying “life happens.” What if your bank, or financial…

Robert Kirk, CEO of InterGen Data at T3 2019 Enterprise Conference

In this interview for T3, Robert Kirk, CEO of InterGen Data gives his insights into T3 2019 Enterprise Conference and talks about the Future of…

#ItzOnWealthTech Ep 27: AI as a Gypsy Fortune-Tell with Robert Kirk from InterGen Data

Robert Kirk was a guest on the #ItzOnWealthTech Podcast with Craig Iskowitz on October 7, 2019. Listen live or download the entire podcast episode using…