September 20, 2022

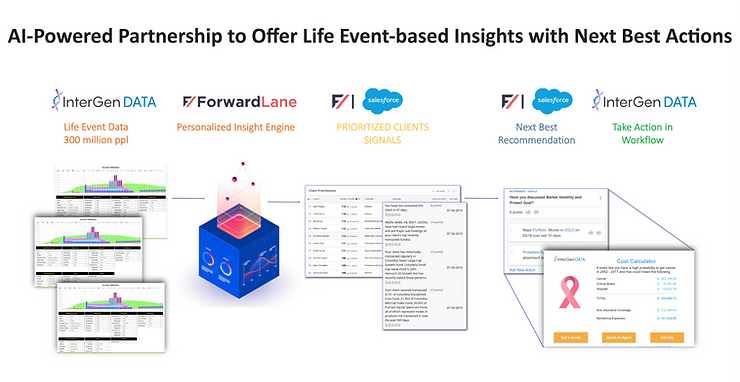

LAS VEGAS, NEVADA, UNITED STATES, September 20, 2022 /EINPresswire.com/ — ForwardLane, the AI-powered, Decision Intelligence Platform that synthesizes personalized insights and next best actions for financial services intermediaries and their clients, is partnering with InterGen Data to offer predictive life-event driven insights based on composite data from 300 million people.

InterGen Data’s predictive modeling provides over 93 health and wealth life events and allows for a more realistic picture of upcoming costs for any individual, family, or household. These events, such as marriage, children, college, divorce, moving, as well as the occurrence of major diseases (cancer, Alzheimer’s, stroke, diabetes, etc.), can directly impact one’s mental health, planning of medical costs, caregiver considerations, and longevity.

ForwardLane’s Decision Intelligence Platform with InterGen Data can generate personalized life-event insights at a client and household level for advisors, brokers, healthcare providers, and carriers. By matching client 360 data with non-PII client characteristics such as gender, age, ethnicity, and zip code the platform automatically cross-checks against structured client data, such as a financial plan, portfolio, insurance products, and retirement annuities to highlight potential gaps or shortfalls and notify advisors or brokers.

“For financial advisors, these personalized, statistically- sound life events treat every investor and family uniquely, with sensitivity given to their identity, geo-location, ethnicity, age, and gender vs. solutions that only use age. The results are that crucial gaps can be readily identified and quantified along with recommended next best actions, products, and educational content. For insurance advisors, the platform can pinpoint opportunities for client engagement that may leverage insurance and annuity products and recommend follow-on workflows such as automated account opening processes with RPA, or insurance illustrations – all the way through to underwriting,” said Nathan Stevenson, CEO & Founder of ForwardLane.

“Today’s inflationary macro-economic outlook, increasing medical costs, and risks associated with greater longevity are major concerns for everyone,” said Robert Kirk, CEO & Founder of InterGen Data, Inc. “This partnership will empower financial advisors, and insurance professionals with big data they need to uncover risks and offer solutions that will help secure the financial wellness of millions of Americans,” Kirk further stated.

About ForwardLane.com

ForwardLane’s AI-powered Insights platform delivers personalized insights and the next best actions for wealth managers, asset managers, and insurers. Human data analysis is time-consuming and expensive. ForwardLane analyzes and synthesizes previously siloed data to distill personalized client engagement opportunities that find clients at risk and ultimately drive revenues. ForwardLane is recognized by the industry as a Wealthtech 100 and AI Fintech 100 globally and counts large financial institutions with $2.5 Trillion AUM as trusted clients.

About InterGen Data, Inc.

InterGen Data, Inc. (InterGen Data) is an AI-based Machine Learning company revolutionizing how financial professionals prepare their clients for impactful life events. InterGen Data’s proprietary algorithms identify the likelihood of a life event occurring, what that event could be, and how much of an effect it would have on the client’s financial future. Their Data as a Subscription “DaaS” and service bureau model delivers actionable insights to financial services firms, healthcare providers, and insurance companies to assist them in identifying coverage gaps, locating hidden risks, and unearthing revenue opportunities.

Forward-Looking Statements

This news release may contain or refer to forward-looking statements. Forward-looking statements give expectations or forecasts of the future using terms such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “will,” “potential,” “look to,” and other terms tied to future periods. Results could differ materially from those expressed or implied in the forward-looking statements. Forward-looking statements are based on assumptions and expectations. They involve risks and uncertainties, including the “Risk Factors” MetLife, Inc. describes in its U.S. Securities and Exchange Commission filings. The company has no obligation to correct or update any forward-looking statement. Parts of this news release may include additional information on forward-looking statements. This news release may also contain measures that are not calculated based on accounting principles generally accepted in the United States of America or GAAP.

Share this article

InterGen Data and Brandeis International Business School Launch COVID-19 Comorbidity Dashboard

December 16, 2020 06:00 AM Eastern Daylight Time Interactive tool uses demographic data from 8.4 million records to predict the potential…

MetLife Digital Accelerator Partners with 10 Startups to Develop Financial Wellness and Engagement

September 15, 2020 09:30 AM Eastern Daylight Time 10 new startups selected to join the 2020 MetLife Digital Accelerator powered by…

InterGen Data named as one of the Top 250 InsureTech firms for 2020 by Novarica

InsureTech Startup Market Continues to Grow, with Increased Focus on Customer Experience and Rapid Time-to-Value for Insurer Partners, Say Novarica

Novarica’s annual report profiles 250…